Recent Commercial Posts

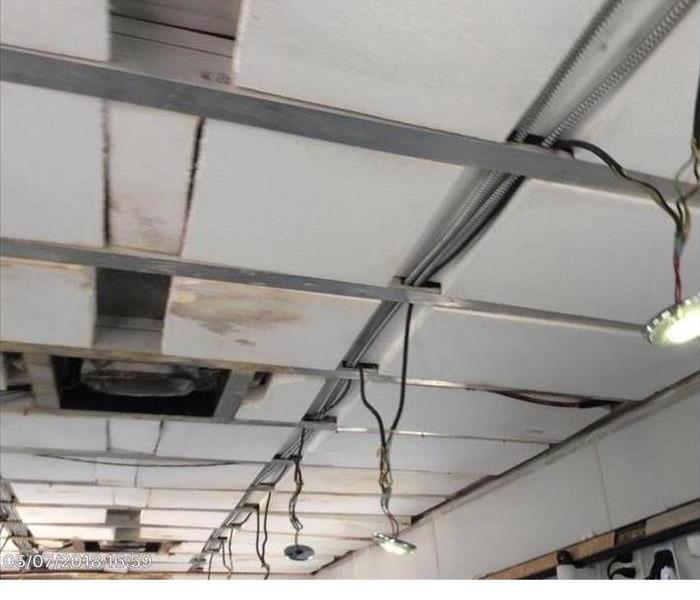

Flooding impact on contents of Commercial Properties

9/12/2023 (Permalink)

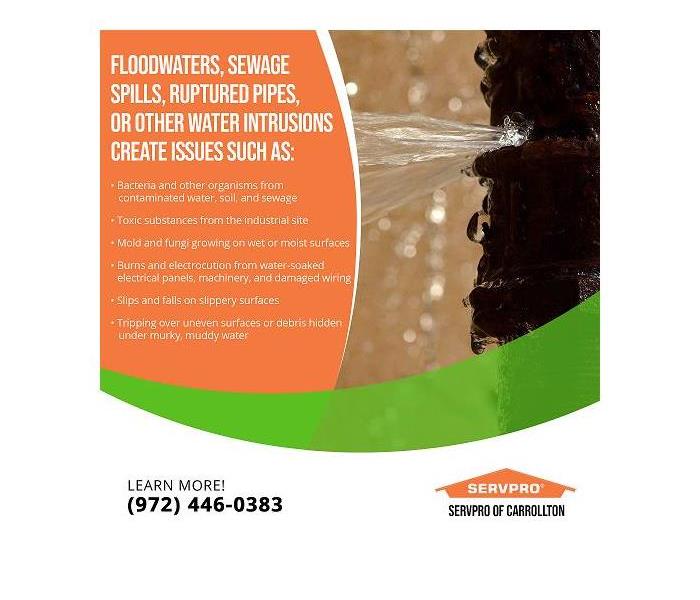

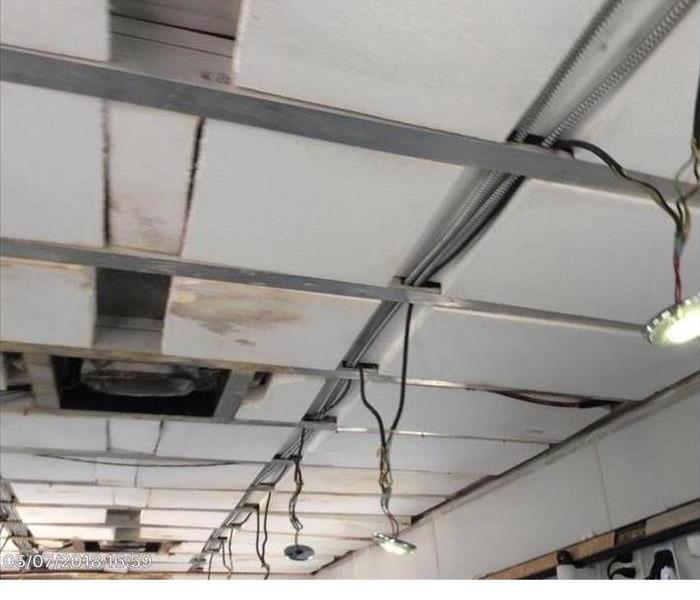

Flooding can have a devastating impact on your commercial property or residence

It can be difficult to predict the full extent of water and storm-related damages. Extracting the water is just the first step that SERVPRO professionals take to thoroughly dry and restore water and storm-damaged areas inside and outside of your property. Floodwater is dangerous, it’s advised to contact a reliable property damage restoration company such as SERVPRO of Carrollton which specializes in natural disaster and flood cleanup and remediation.

It can be difficult for the average property owner or management team to determine if the contaminated areas and contents of your property have been properly remediated, to avoid continued damage from mold growth.

Our restoration technicians are IICRC trained and certified with countless hours of experience responding to local property damage cleanups and repairs. While assessing your property damage, SERVPRO of Carrollton will help determine what parts of your loss our team can clean, sanitize and restore.

Our restoration teams work closely with our construction crews and management to provide a seamless transition from destruction to reconstruction. That's why it's best to call a local property disaster restoration company like SERVPRO of Carrollton to fill in the blanks.

Our Professional staff will come and inspect your damage and customize a removal, cleanup, and restoration solution to get your property damage reversed as quickly and effectively as possible.

Different Types of Contaminated Water Categories

Category 1: Clean water originates from a sanitary source such as a broken pipe, or another water source; rainwater is also considered clean and poses no substantial risk from dermal, ingestion, or inhalation exposure. However, it may not always remain clean after it meets other surfaces or materials.

Category 2: Gray water is used to classify slightly contaminated water and has the potential to cause discomfort or sickness if contacted or consumed by humans. It may contain potentially unsafe levels of microorganisms or nutrients for microorganisms, as well as other organic or inorganic matter (chemical or biological).

Category 3: Black water is highly contaminated and filled with pathogenic, toxigenic, or other harmful agents. Such water sources may carry silt, organic matter, pesticides, heavy metals, regulated materials, or toxic organic substances. Black water is typically caused by sewage damage, flooding or any type of natural disaster; black water should always be handled by trained professionals.

Different types of contaminated water pose different risks, but the longer the water stays in a home, the more severe the property damage it will cause and the greater the threat to your health. Also called black water, Category 3 water is water from sewage backups and overflowing rivers that contains various hazardous contaminants, sewage, and/or toxic debris. According to the Institute of Inspection Cleaning and Restoration Certification (IIRC) and the Environmental Protection Agency (EPA), all water originating from seawater, ground or surface water, rising rivers and streams, and wind-driven rain from hurricanes and tropical storms is considered Category 3.

Are you planning to open a new business in Carrollton?

4/13/2023 (Permalink)

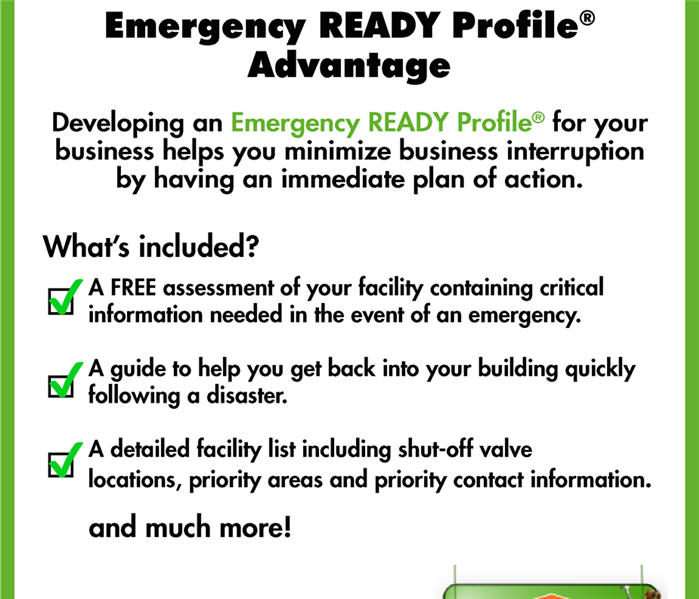

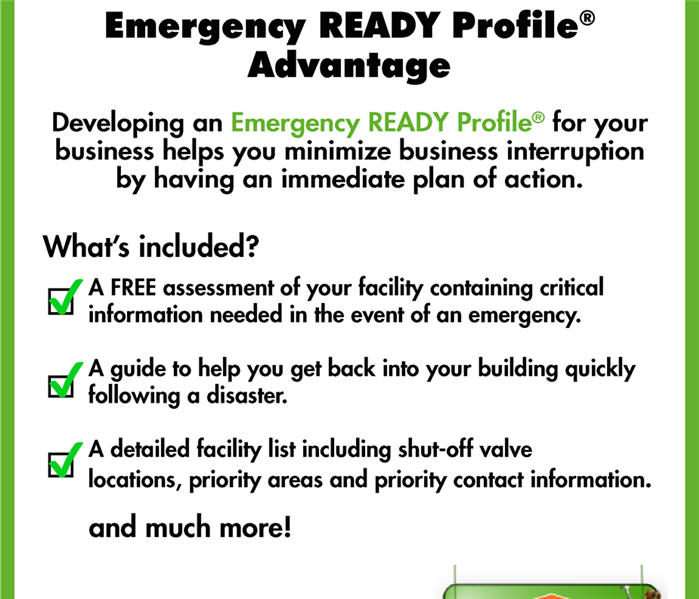

There is a lot to consider when opening a new business. One aspect that most owners do not want to think about but should is being ready for disaster. Whether it is fire, flood, mold damage or biohazard issues, having a plan in place can save time and money, and may make the difference between whether your business stays open or not.

Work with your local SERVPRO to design a plan to anticipate your issues and put in place a plan of practical solutions ahead of any troubles.

When damage happens at your place of business

Whether you own a restaurant, a retail enterprise, or manage an event center, your responsibility is to keep the doors open and provide the services or products you promise your clientele. Unfortunately, a broken pipe or appliance malfunction sends water surging through your business, possibly closing you down until the experts to arrive to get the situation managed.

Fire, mold, or a crime scene situation can present similar operational challenges. Without a plan, which can waste precious time. SERVPRO suggests working on a proactive blueprint to streamline the assistance we can offer to get you back in business fast.

What does a disaster response plan include?

SERVPRO creates a comprehensive disaster response action strategy for damage with significant input from the business owner. Our Emergency Ready Plan and Profile (ERP) is not a one-size-fits-all approach. We take the time to visit your company location and to talk with you to assess your needs and understand how you deliver your goods or services. The assessment is free of charge and allows us to make a range of suggestions to limit your risk if your commercial space does experience a damage event such as fire, flood, or mold damage.

Our experienced project manager walks through your business and sketches out your layout, including vital information like utility shutoff locations. We gather information, take pictures, and determine how we best meet your needs if your site is damaged. Having as much information documented before disaster strikes will help businesses react quickly, smartly, and effectively to keep damage to a minimum and operations less impacted should disaster strike.

How SERVPRO’s ERP works

Business owners take an additional step to increase our knowledge by completing your business’s profile on the SERVPRO ERP mobile app. On the app, indicate that SERVPRO of Carrollton is your preferred provider. List any vendors and contractors who have essential information about your equipment and systems.

Designate employees or others whom you allow to act on your behalf if you are unavailable during the water crisis. Gathering all this information is critical to a fast and effective response if a water emergency occurs.

Planning for an emergency should be a part of any new business opening. The professionals at SERVPRO of Carrollton are by your side during an emergency. Be prepared by developing an Emergency Ready Plan and Profile we can use if the worst happens so we can react quickly to protect your business.

Call for a FREE consultation---972-446-0383!

Where is that smell coming from in your office building?

4/3/2023 (Permalink)

#likeitneverevenhappened

#likeitneverevenhappened

Commercial odor removal is the process of identifying and eliminating unpleasant odors from your Dallas commercial property. These odors can be caused by a variety of factors, such as mold, smoke, pets, cooking, chemicals, and many other sources.

Unpleasant odors can have a negative impact on the indoor air quality and create an uncomfortable environment for employees, customers, and visitors.

Did you know SERVPRO of Far North Dallas and Carrollton has the skills and experience to clean up even the most offensive odors?

The process of commercial odor removal typically involves the following steps:

- Inspection: A trained professional inspects your Warren commercial property to identify the source of the odor and the extent of the damage.

- Elimination: The odor is eliminated using specialized equipment and techniques, such as air purifiers, dehumidifiers, and ozone generators. Depending on the source of the odor, different techniques may be required.

- Cleaning: The affected area is thoroughly cleaned and disinfected to remove any remaining odor-causing particles.

- Prevention: Measures are taken to prevent future odor problems, such as improving ventilation, using air purifiers, and maintaining a clean environment.

- Testing: Air quality testing may be performed inside your Champion commercial property to verify that the odor has been eliminated and the indoor air quality has improved.

Commercial odor removal can be a complex process and should be handled by a professional restoration company with experience in this area. It is important to address odor problems promptly to prevent further damage and ensure a safe and comfortable environment for employees, customers, and visitors.

If you are experiencing offensive odors in your Dallas commercial property, call 972-446-0383.

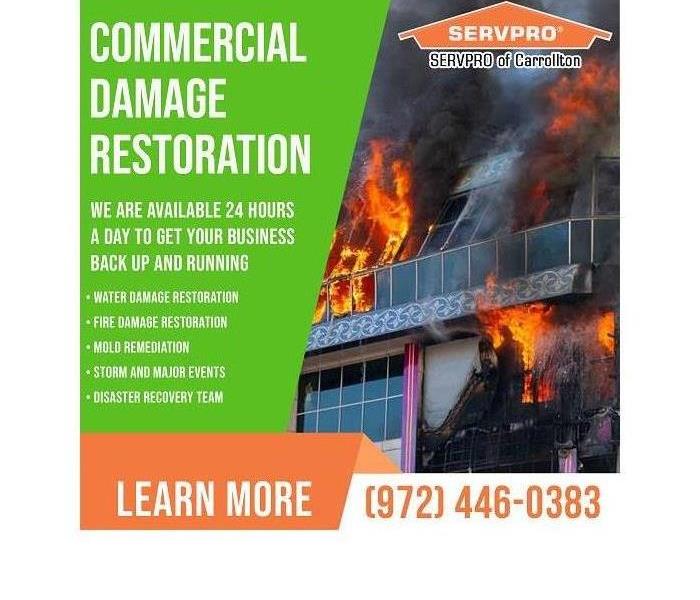

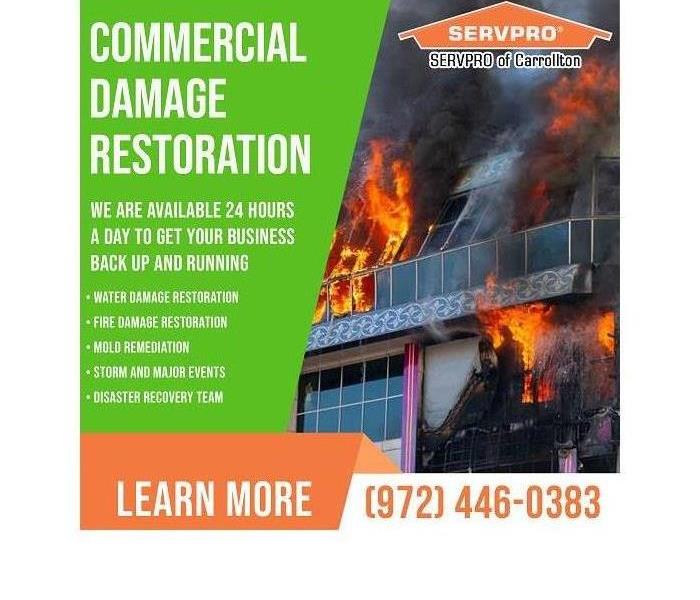

One Stop Shop for Commercial Restoration

3/14/2023 (Permalink)

7x24x365

7x24x365

SERVPRO is your one-stop shop for commercial construction. While running the daily functions of your business, the last thing you want to worry about when you have a need for restoration or reconstruction is contacting and managing multiple repair crews.

We’ll work with your insurance company to restore your commercial property to help make it “Like it never even happened.” Our goal is to complete your commercial restoration project on time and within the budget with as little downtime to your business as possible. SERVPRO has competent and experienced professionals that believe in delivering quality workmanship.

Our full-service process includes: inspection and estimating, mitigation, restoration and reconstruction. We also offer premium services for dust control and protection from COVID-19 and other contaminants using our proprietary, EPA-registered products.

Insuring fitness centers against water damage and fire damage

1/18/2023 (Permalink)

Blog Summary: SERVPRO® of Carrollton explains insurance coverage options for sports and fitness center businesses.

SERVPRO of Carrollton provides the fire damage, smoke damage, and water damage restoration services that sports and fitness centers in Far North Dallas, TX, need to resume operations as quickly as possible after property damage. The insurance claims process can be challenging to maneuver. SERVPRO of Carrollton can handle the insurance claims process from beginning to end so the business owner can focus on serving customers and clients.

Commercial property insurance assures business owners that their financial future is secure in the event of fire damage, smoke damage, water damage, or other types of property damage. Insurance pays to clean up and restore the damage. Fitness equipment damaged by fire, smoke, water, or vandalism will be repaired or replaced. Also, the structural damage will be repaired if the facility is damaged or destroyed. Any unsalvageable inventory is covered. Retention of existing members and recruitment of new members are two critical components to success, and nonfunctional workout and exercise equipment can directly impact the revenue stream and the recruitment of new members. Disruption of services can short-circuit retention and the influx of new members, crippling the business. Commercial property insurance will not prevent a disaster but can facilitate a fast recovery and return to normal business operations. An understanding of the critical components of commercial property insurance is foundational. The tips and topics below will focus attention on the pillars of the commercial property insurance policy.

Coverage

The policy covers the following:

- buildings owned or leased by the operator and outdoor property not attached to the building

- items in the care, custody, or control of the entity

- furniture, office equipment, janitorial equipment, laundry equipment, and supplies

- artwork

- fitness equipment

- inventory, such as health foods and beverages, essential and aromatic oils, and merchandise

- personal property of customers while in the care of and on the premises of the facility

Bonus tip: Coverage of customers’ belongings is often low. Bailee’s customer insurance is a type of insurance designed to limit the business’s exposure. If the equipment attendant drops a dumbbell on a customer’s phone, then the damage is covered.

Exclusions

The business owner must be aware of any exclusions in the policy. Electronic data, such as software and customer records, are not covered. Consult an insurance agent about procuring a separate electronic data policy. A commercial policy will replace or repair a computer damaged during a fire, but it will not cover the cost of data recovery. Company vehicles are excluded, as well. An auto policy must be obtained for the fleet.

Risks coverage: Named perils and open perils policies

The owner/operator of a fitness center can choose an open perils policy or a named perils policy. An open perils policy covers all perils except those excluded from the policy. A named perils policy covers specific risks delineated in the contract.

Common named perils include:

- fire and smoke damage

- water damage (HVAC, plumbing, fire sprinklers)

- weather events (hail, windstorms, lightning)

- explosions

- the impact from vehicles or airplanes (The business’s vehicles and aircraft are excluded.)

- sinkholes

- falling objects

- riots, civil commotion, and vandalism

An open perils policy, usually more expensive because of the broader coverage, makes sense if the fitness center has a large amount of very expensive equipment.

Many exclusions are listed on both named and open perils policies. Examples of exclusions include, but are not limited to, the following:

- earthquakes, landslides, or volcanic activity

- water events (flooding, sewage or drain overflows, mudslides, tsunamis

- mold, bacteria, rot (both wet and dry)

- damage or loss incurred due to compliance with an ordinance or law

- war and military action

- nuclear hazards from a nuclear power plant

An endorsement can be added to the policy to cover any excluded peril.

Replacement cost vs. actual cash value policies

A business has two avenues for valuing its property. Replacement cost (RC) coverage pays for repairing or replacing damaged property. Be aware that depreciation is not applicable in this situation. The other option, actual cash value (ACV), covers the replacement cost of the damaged item at the time of the loss. Depreciation is factored into the valuation of the damaged property. The higher payout for replacement costs elevates premiums for replacement cost coverage.

Additional insurance coverage

Consult with a qualified and experienced insurance agent for information about additional coverage such as coinsurance, equipment breakdown insurance, virtual or remote fitness coverage, inland marine insurance, and business income insurance.

What to do in the event of a property damage disaster

The sports and fitness industry depends on the business's location, the facility's quality, and the equipment's functionality. Damage to the property and equipment or a forced relocation can ruin a business. A quick cleanup and restoration after a property damage disaster are vital if this type of business survives.

SERVPRO of Carrollton is available 24/7, 365 days a year, including holidays. Crews can be on-scene in about an hour. The rapid response and quick cleanup and restoration enable a fitness center to be up and running almost immediately. Customers may not notice any disruption, depending on the location and size of the damage.

The best time to secure the services of a property damage restoration service is before a disaster. By pre-qualifying with SERVPRO of Carrollton as the dedicated service provider, a property damage disaster only requires one phone call to begin the restoration process.

To learn more about Far North Dallas, TX, water damage restoration services, contact SERVPRO of Carrollton by phone at (972) 446-0383 or by email at office@SERVPRO10952.com.

Water Damage and Restoration for Businesses.

11/14/2022 (Permalink)

If you’re a business owner, any kind of water damage to your facility needs to be remedied quickly with the least amount of downtime to your daily business functions. A call to SERVPRO will help you get water damage repaired and restored in order to minimize downtime and prevent loss of revenue.

Whatever size the water damage is to your business, we have the experience and equipment to deal with it. Our professionals will work closely with you and the other occupants of your building during the restoration process to have as little disruption as possible to your daily business activities.

Call today 972-446-0383.

We are locally owned and support businesses in Carrollton.

11/7/2022 (Permalink)

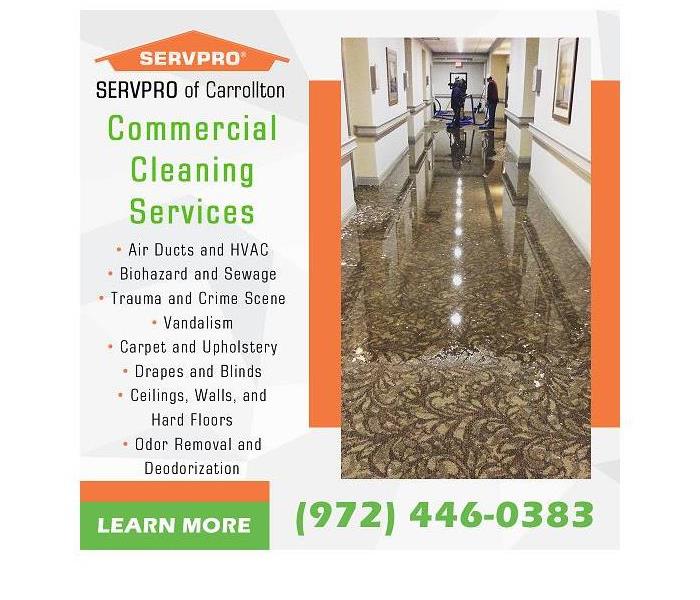

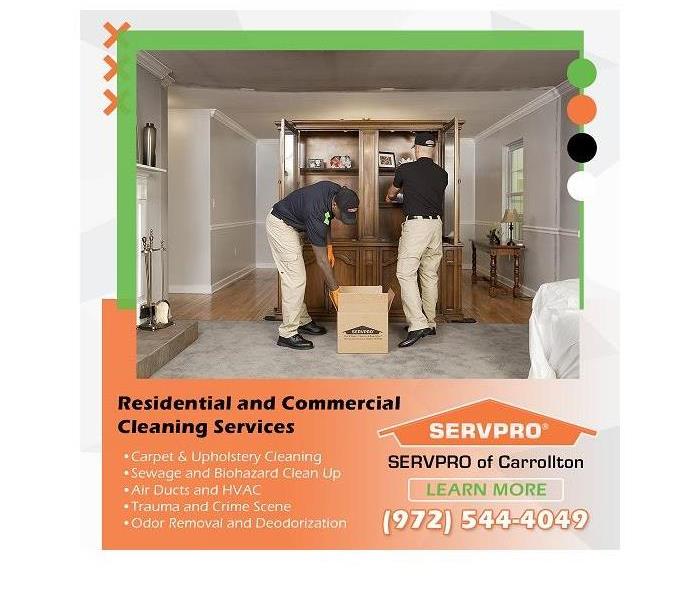

Providing Your Business Cleaning Needs

You work hard every day to build your business, so the last thing you need to deal with is a disruption to your daily functions. But accidents-both large and small- can happen at any time. SERVPRO can help during those times with specialty cleaning for your commercial property.

We have the equipment and experience to get the job done, whether you have a routine need, like air duct and HVAC system cleaning, or face a major emergency, such as biohazard and crime scene cleanup. Or, maybe you’ve had an outbreak of COVID-19 and need a clean reset.

Our professionals are skilled and work with the most advanced cleaning products and techniques to clean and restore your commercial property so you can focus on getting back to work with the least amount of downtime possible.

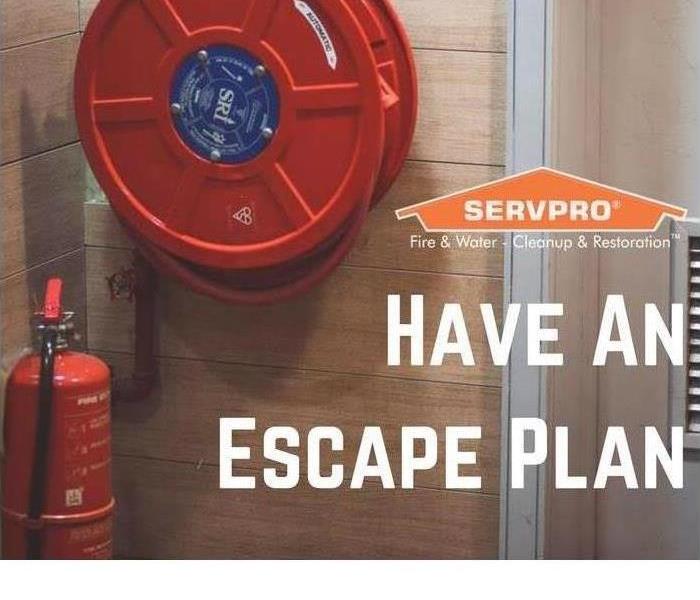

Fire Safety Best Practices to Help Carrollton, TX, Businesses Prevent Fire Damage

10/11/2022 (Permalink)

Blog Summary: SERVPRO of Carrollton highlights tips for promoting fire safety in a commercial facility.

SERVPRO® of Carrollton provides commercial fire damage restoration for businesses, professional office complexes, manufacturing units, schools, and other educational institutions. When the property damage restoration needs are large and need quick action, SERVPRO can scale to meet the challenge.

Commercial fire safety strategies

A fire damage disaster in a commercial environment or workplace has the potential to cause personal injury to employees, ruin inventory, destroy machinery used in the production of products, damage office equipment, and cause massive structural damage to the facility. Sometimes the consequences are tragic, resulting in fatalities.

Workplace fires pose a constant risk and annually cause millions of dollars in property damage. Some fires are entirely accidental or act of God. In other instances, fires are a result of negligence, carelessness, or arson.

Appropriate fire prevention strategies, a well-trained workforce, and a strong corporate culture of fire safety and awareness are key elements of maintaining a fire-safe environment in the workplace. SERVPRO® of Carrollton offers fire prevention strategies as a starting point to create a culture of fire prevention and safety.

Formulate a comprehensive fire safety plan

Employees must be well acquainted with the company’s fire safety plan so that in the event of a fire, the proper response is responsive and second nature. A fire prevention strategy and a safe evacuation route are foundational. The plan should be formalized in writing and conspicuously posted in prominent areas in the workplace. The plan can be made easily accessible in a digital format through the use of a QR code.

Some critical elements of the plan include the following action steps:

- The identification of evacuation routes, which also should be clearly marked

- The implementation of a well-defined evacuation protocol, which should include a process that accounts for all employees once the evacuation is completed

- Instruction on how to activate the facility’s emergency notification system

- The location of fire extinguishers or other fire suppression equipment

- The designation and clear identification of safe areas

- The highlighting of all major fire hazards

- Instruction and hands-on training in the proper management, handling, and storage of hazardous materials

- The creation of a flow chart listing the names and titles of designated fire safety personnel

Fire safety tips for the workplace

The top priority in the event of a workplace fire is the personal safety of each employee. A swift, safe evacuation will save lives. Familiarize employees with evacuation routes so that if a fire should occur, each employee will know how to evacuate the facility no matter where they find themselves at the time of a fire event. Emergency exits should be well-marked and well-lighted.

Make the workspace a safe place. Maintain a clean, uncluttered, dry, dust-free, and well-ventilated workspace. Organization fosters efficiency and awareness while eliminating distractions. Clutter on the work floor may impede evacuation and increase the risk of a trip-and-fall injury. If the power to the facility is interrupted, auxiliary lighting may be dim. In this case, clear evacuation lanes become vital.

Utilize a fire safety checklist. The list should be easily visible and accessible. A sturdy, laminated infographic, in tandem with the printed checklist, reinforces important fire prevention information while accommodating employees with different learning styles.

Be aware of the fire risks of equipment. Heat-producing equipment should not be used near combustible materials. Extreme caution should be exercised in the use and storage of flammable liquids and chemicals.

Electrical safety can reduce fire hazards in the workplace since electricity is involved in nearly four in ten workplace fires. Electrical cords should be inspected when used, and damaged cords should be repaired or replaced. Compromised or damaged electrical outlets should never be used. Overloading an outlet has never been easier with the growing demand to recharge devices. Where this fire hazard exists, consider installing GFCI outlets.

Functional smoke alarms save lives. Smoke detection systems are crucial in office areas, especially in the break room where electrical appliances such as the coffee pot and microwave are located. Schedule and document testing of smoke alarms and CO detectors at least once a month. Replace batteries every year. Smoke alarms should be replaced around every ten years. If a smoke alarm is giving off an annoying chirping noise, do not remove the battery. Instead, replace the battery immediately. It is too easy to remove the battery and then forget to replace it.

Fire extinguishers are a cornerstone of immediate fire suppression. A delinquent inspection protocol puts everyone at risk. Instruct employees on how to safely operate the devices. The location of fire extinguishers should be clearly marked. Avoid obstructing access to fire extinguishers.

Remember, these fire safety prevention and emergency response tips are basic and do not reflect an exhaustive solution. A comprehensive fire safety program requires much time and effort, as well as professional input.

In the event of a fire damage disaster in a commercial environment, the team of professionals at SERVPRO of Carrollton is available 24/7, 365 days a year. Unlike most property damage restoration companies, SERVPRO can scale to meet any size of disaster. The rapid response helps businesses quickly recover from a property damage disaster.

To learn more about fire damage restoration for Carrollton, TX, businesses, reach out to SERVPRO of Carrollton by email at office@SERVPRO10952.com or by phone at (972) 446-0383.

We assist many companies in the Food Service Industry.

9/21/2022 (Permalink)

Services for the Food Service Industry

From the smallest mom-and-pop restaurant to food processing plants, SERVPRO of Bent Tree and Carrollton has the experience and equipment to restore your facility to its preloss condition following a disaster.

Time and safety are our top priorities, just as they are to you in running your business. Our highly trained technicians are available 24/7 to help mitigate the damage done to food manufacturing facilities and commercial kitchens, so you can get back to serving your customers safely and quickly.

We also offer a proactive solution for your business to be prepared in case an emergency occurs. It is called an (ERP) Emergency Ready Plan. It is a free service that we offer our customers.

SERVPRO technicians are trained and experienced in the cleaning and restoration of food service facilities of all sizes, including:

- Food Manufacturing Facilities

- Fast Food Establishments. Restaurants and Cafeterias

- Food Processing Plants

- Commercial Kitchens

For more information, call our office today-

972-446-0383

Have a Plan in Place Before the Storm hits your Building.

9/16/2022 (Permalink)

When disaster strikes your business, having a plan in place ahead of time for what you will do can make all the difference in whether your business survives the event. The majority of businesses that come out stronger on the other side of an emergency are the ones that pre-planned for one.

SERVPRO of Bent Tree and Carrollton offer free evaluations for our commercial customer's properties.

We will identify strategies that will save you time and money during a water emergency, fire or any hazardous condition.

We call this service an "ERP" or Emergency Ready Plan.

Please give us a call today if this is something you would like to discuss.

972-446-0383

Effective Ways a Business Can Recover Costs after a Commercial Property Damage Disaster

8/10/2022 (Permalink)

Blog Summary: SERVPRO of Carrollton outlines cost recovery strategies for businesses affected by water damage and fire damage.

The damage restoration and mold remediation experts at SERVPRO of Carrollton understand that property damage is complicated. Often, fire damage entails extensive smoke damage. Another dimension of the disaster is the water damage from efforts to suppress or extinguish the flames. If the water and moisture issues are not immediately addressed, advanced secondary damage not directly caused by the fire can occur. A dark, wet, warm structure is a prime breeding ground for mold, so a fire, smoke, and water damage disaster also becomes a mold remediation project. A fire in a commercial environment requires a multifaceted response from the cleanup and restoration company. The damaged business also needs cost recovery strategies to cope with the catastrophe.

Cost recovery strategy: Involve a client advocate in the inspection and assessment process

One of the most important cost recovery strategies starts at the ground level of the cleanup and restoration process. It involves the damaged business’ assessment of the damage and the relationship with the insurance company. A thorough inspection of the situation and evaluation of the damage by a qualified, experienced cleanup and restoration expert who acts on behalf of the business owner is crucial. The involvement of a seasoned contractor ensures that the interests of the business are prioritized and that the assessment and estimate accurately represent the scope of the restoration project. No issues will be overlooked, and no corners will be cut. The participation of a client advocate ensures all damages are identified and restored, accurate claims are filed with the insurance company, and the claim payout covers the losses. Surprises in a restoration project can be expensive.

An industry expert explains the need for professional involvement from the very beginning of the project: “Fire damage in a commercial building sets into motion a complicated recovery cycle that can take months to complete. Assessing the damage is just the beginning, but if you don’t get that part right, the entire recovery process can become more complicated than it has to be. When you turn in a claim for your commercial property loss, your insurance company will assign a property adjuster to appraise your business property damage and eventually pay your claim. It’s important to remember that the adjuster works for the insurance company, not you. Adjusters are primarily interested in documenting damage, fire cause and origin, ruling out arson, final repair cost, and settling economically and quickly. The insurance property adjuster may be inexperienced or may not have the expertise to locate and evaluate all the areas of hidden damage. Your adjuster might not thoroughly understand what’s covered under your business policy. Adjuster inexperience can have a profound effect on your claim, but you may never know it’s a problem unless you have a knowledgeable professional working on your behalf.”

Cost recovery strategy: Identify and assess all the property damage

Make sure a trained and experienced professional documents visible, obvious damage during an initial inspection. It is understood that hidden damages may be discovered during the cleanup and restoration process. The hidden damages and unforeseen expenses may include:

- Damage to electrical components

- Increased labor and material costs

- Damage to industry-specific machinery

- Fire, smoke, and soot damage to insulation, behind walls, and in ventilation ducts

- The difficulty, success, or failure of cleaning soot and smoke from upholstery, fabric, or other porous items

The goal of this strategy is to avoid cleanup and damage restoration surprises that may negatively impact insurance claims payouts in other areas. Delays in the restoration process that lead to a longer interruption of normal operations may result in a reduced payout for loss of business income. If the delays are deemed unreasonable, then the business may not be compensated for the duration of the delay.

Cost recovery strategy: Obtain professional help to deal with insurance claims

The commercial insurance claims process is complex. Successful, swift navigation of the process requires training, expertise, and experience. Most business owners lack the knowledge and time to successfully navigate the claims process quickly and accurately. Delays cost time and unnecessarily forfeit potential revenue.

SERVPRO of Carrollton is well-acquainted with the commercial and residential insurance claims process. Highly trained and experienced staff takes care of the details from end to end, allowing the business owner to give full attention to recovery from a property damage disaster and the return to normal business operations.

For more information about commercial property damage restoration and mold removal, in Farmers Branch, TX, call SERVPRO of Carrollton at (972) 446-0383 or email the team at office@SERVPRO10952.com

Commercial Cleaning of Air Ducts and Dryer Vents.

7/27/2022 (Permalink)

Does your business have a clothes dryer? Dryers, especially those that are used frequently for commercial use, can collect excess lint and debris in the vent line. This excess lint is the most common source of ignition for dryer fires, which account for 15,500 fires every year. In addition to the risk of fire, excess lint and debris can lead to clogs and decreased efficiency, as well as additional energy use. SERVPRO of Carrollton provides professional commercial dryer vent cleaning services to a wide variety of businesses with clothes dryers.

Our Current Commercial Dryer Vent Cleaning Clients

- Salons

- Spas

- Pet groomers

- Hotels

- Hospitals

- Medical clinics

- Chiropractors

- Laundromats

- Fitness centers

- Daycare facilities

- Senior Living homes

- Veterinary clinics/hospitals

Commercial Dryer Vent Cleaning Benefits

Our commercial dryer vent cleaning services offer business owners many benefits. First and foremost, by having your dryer vents cleaned by our experienced technicians, you can be sure that the risk of dryer fire in your building is minimized. In addition to removing the fire hazard, our services will ultimately save your business time and money by increasing your dryer's efficiency.

For more information, please call 972-446-0383!

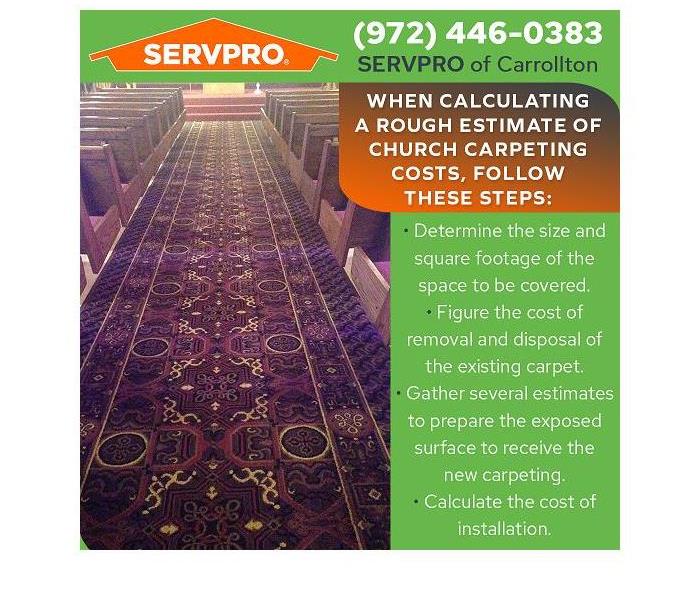

How Hebron, TX, Places of Worship Can Benefit from Carpet Cleaning Services

6/8/2022 (Permalink)

Blog Summary: With years of experience and knowledge in the restoration and cleaning industry, the team at SERVPRO of Carrollton delivers commercial carpet cleaning services for local churches and places of worship.

SERVPRO of Carrollton is well-known for fire, smoke, and water damage restoration in Hebron, TX. The SERVPRO team is also an industry leader in residential and commercial carpet cleaning services.

Beauty and functionality are two important factors to consider when selecting a floor covering for a church. Beautiful, comfortable accommodations can greatly enhance the worship experience. Carpet has been the traditional choice for many churches in the past and will continue to be popular in the future. Outlined below are some practical considerations to keep in mind when making decisions about what carpeting to install in a church renovation or new construction project.

Flooring Options

Churches have many flooring options from which to choose, including linoleum, tiles, hardwood, engineered wood flooring, laminate, luxury vinyl planks (LVP), luxury vinyl tile (LVT), and carpeting.

Special Considerations: Durability, Safety, and Aesthetics

Floor covering in churches must be able to hold up under high foot traffic. High-quality carpet is very durable, withstands heavy use, and is stain resistant. If needed, this versatile floor covering can be easily repaired or replaced. Better quality carpet has a longer lifespan and may make more financial sense than other flooring choices.

Also, the flooring must be user-friendly, posing a low risk for slips and falls. Safety features are essential for graying congregations who may be anxious when navigating areas they perceive as unsafe. Moisture and dust on smooth-surfaced flooring and unevenness in planked flooring can lead to slip-and-fall injuries.

The appearance and texture of the floor covering can shape the congregation’s experience in the facility. Beautiful, high-quality carpet can make the sanctuary warm and inviting. For many people, a well-carpeted church will feel like home. Carpeting may also soften the harsh acoustics of amplified sound, making the listening experience more pleasant.

The Cost of Church Carpeting

Premium quality flooring products are a significant capital investment. Carpeting is no exception. Pricing is usually figured per square foot. Commercial-grade carpeting is engineered to withstand the pounding and wear from high foot traffic. Residential-grade carpeting will not hold up in a commercial environment. In the long run, premium quality commercial carpeting is cost-effective.

Better quality commercial carpeting may cost five or more dollars per square foot, and premium quality products may be more expensive. When calculating a rough estimate of church carpeting costs, follow these steps:

Step 1: Determine the size and square footage of the space to be covered.

Step 2: Figure the cost of removal and disposal of the existing carpet.

Step 3: Gather several estimates to prepare the exposed surface to receive the new carpeting.

Step 4: Calculate the cost of installation. The several components of installation include:

- Labor

- Adhesives

- Moisture mitigation

Moisture can be a problem. To avoid or resolve moisture issues, some flooring companies are applying a two-coat epoxy sealant to the surface to prevent moisture issues. This process can cost as many as six or more dollars per square foot.

Churches should secure bids from multiple carpeting sales and installation companies. The cost-benefit of using a single supplier and installer can be substantial. Make sure the quotes encompass the entire project from end to end. Request detailed documentation with the quote. There should be no hidden costs or surprises. Select a reputable company and check references and online reviews.

Carpet Cleaning and Maintenance

Trust a professional carpet cleaner to remove dirt and grime to keep the carpet looking its best. Grit and dirt in the carpet can shorten the lifespan of the product, especially in high-traffic areas. SERVPRO of Carrollton uses a variety of commercial carpet cleaning methods depending on the type and condition of the carpet.

Carpet Cleaning Methods

The team at SERVPRO utilizes several specialized methods to clean carpets.

- Bonnet Cleaning

- Hot Water Extraction

- Deluxe Pre-Condition and Rinse

- Showcase Premier Cleaning

- Dry Cleaning

SERVPRO of Carrollton has a carpet cleaning method for every situation. Homeowners, businesses, and churches in Hebron, TX, and the surrounding communities can rely on the SERVPRO team for excellent results.

To learn more about SERVPRO of Carrollton’s carpet cleaning services, as well as water damage cleanup, fire and smoke damage restoration, and mold remediation, contact the water damage restoration and cleaning specialists by phone at (972) 446-0383. The office can also be reached by email at office@SERVPRO10952.com.

How to Avoid a Fire Sprinkler Accident That Can Lead to Commercial Water and Mold Damage

5/18/2022 (Permalink)

Blog Summary: SERVPRO of Carrollton offers a four-step plan to mitigate water damage from a fire sprinkler system activation or water leak.

Commercial water damage cleanup, restoration, and mold removal may be needed when a fire sprinkler system is deployed accidentally, spewing hundreds of gallons of water into the workspace, exam room, or retail space. In all of these situations, cleanup and restoration must be quickly initiated and rapidly completed so the business can resume normal business operations.

In most loss prevention strategies, the traditional fire sprinkler system is a key frontline defense against fire damage in the commercial sector. Concerning fire damage, fire sprinkler systems do afford peace of mind to property owners and facility managers. However, one-fourth of all property claims are related to a water loss, and these claims surpass $5 billion in property damages annually. A nagging concern persists regarding the possibility of a sprinkler system springing a leak and causing localized water damage. A worst-case scenario would be a malfunction in which the full activation of the system when the facility is vacant and closed for the weekend, evening, or holidays. This scenario would be catastrophic for the business.

Practical steps to minimize the frequency and impact of water damage from a fire sprinkler system

- Conduct regular inspections of the facility and the sprinkler system.

- Create a culture of water leak awareness and intervention.

- Carry out intentional testing.

- Implement maintenance, repairs, and pre-emptive replacement.

Step #1: Inspect the system for leaks.

Inspections can identify leaks in their infancy. Repairs can be made before equipment, inventory, raw materials, furniture, electronics, and important documents are damaged or destroyed.

Step #2: Create a culture of water release awareness and intervention.

Management can create a culture of water release awareness by consistently including the topic in daily updates, team briefings, and company-wide quarterly and annual meetings. Include a water release awareness flyer on company bulletin boards, and post flyers near the water cooler, breakroom, copy center, and restrooms.

Teach employees and staff the signs of a slow water leak. Key indicators are unexplained puddles of water on flat surfaces such as desks, file cabinets, tables, and especially the floor. Floor spills should receive immediate intervention to prevent slip-and-fall injuries. Sourcing the water or moisture is the next step. The first reaction should be to look up to the ceiling for a fire sprinkler head. If one is near or directly above the release, have the device inspected by the maintenance personnel or a fire sprinkler professional.

Moisture spots on fabrics and other absorbent materials should flag attention. Moist spots on paper, magazines, books, documents, and clothing are a telltale sign of a slow water leak. Special attention should be paid to moisture and pooled water on electronics, control panels, robotics, and electrical outlets. Small amounts of water on or near electrical circuits or electronic components can cause serious damage.

In a manufacturing unit or warehouse where a sprinkler system is configured to dispense a blanket of water over the production or storage area, a heightened awareness must be exercised by the regular employees and the maintenance crews. Raw materials and chemical compounds that are water-reactive present elevated risk hazards for personal injury and property damage. Fire or explosions may result when the materials are brought into contact with water or moisture.

A rapid-response notification system will improve employee participation. A dedicated text number for receiving notifications and documenting the water damage response by management will also enhance buy-in with the employees and onsite vendors and contractors.

Step #3: Carry out intentional testing.

Visual inspections are an indispensable component in any strategy to avoid the accidental activation of a fire sprinkler system. Intentional testing evaluates both the system and the hardware. Controlled tests by professionals yield real-time results that authentic the operational functionality of the sprinkler system.

Step #4: Implement regular maintenance, swift repairs, and pre-emptive replacement of aging, damaged, or defective parts.

High maintenance standards keep the fire sprinkler system in peak condition. When leaks or issues are reported, rapid repair not only resolves the problems, but also prevents a larger water release and the possibility of advanced secondary water damage that can result in mold, mildew, wood rot, or corrosive rust on metal and machinery. Pre-emptive replacement of sprinkler components as recommended and performed by fire sprinkler professionals is advisable to avoid an unwanted water discharge that could cost much more than the replacement of a simple, inexpensive sprinkler head.

Prepare for water damage: Pre-qualify a commercial restoration company

Pre-qualify a property damage restoration company before a disaster strikes. The chaos, confusion, and stress of dealing with a property damage disaster make finding a reliable, competent provider almost impossible.

The professionals at SERVPRO of Carrollton provide commercial water, fire, smoke, storm, and flood damage restoration. They offer twenty-four-hour emergency service, highly trained restoration technicians, and a rapid response to the damage scene. Locally owned and operated, SERVPRO can scale to any size disaster and handle the complex hazards presented by a commercial environment. The best equipment, the latest technology, and advanced cleaning techniques make SERVPRO of Carrollton an excellent choice for commercial property damage cleanup and restoration.

For more information about commercial mold remediation and water damage cleanup in Farmers Branch, TX, and surrounding areas, email SERVPRO of Carrollton at office@SERVPRO10952.com. The office can also be contacted by calling (972) 446-0383.

We can restore your Dallas Business to Pre-Damage Condition.

4/20/2022 (Permalink)

Commercial Flood Damage Cleanup In Dallas

Small businesses in Dallas are particularly vulnerable to disasters like fire and flood. They do not have the assets of a national network to fall back on, so shutting down for restoration and cleaning for even a week can mean closing their doors permanently.

Commercial flood damage to a Dallas business like a convenience store needs cleaning by a professional restoration company. SERVPRO technicians train extensively to remove water, replace unsalvageable building material, and dry all restorable property.

Most commercial water damage comes from an activated sprinkler or a broken water line. That is treated water, and considered clean, requiring no special efforts to remove it from the business. With flood damage, water comes from outside, usually after a storm. This water is contaminated and can contain soil and other contaminants like pesticides and animal waste. Before starting other efforts, technicians spray the water and all affected surfaces and items to kill any bacteria.

Now, they use pumps and extraction wands to remove the water. The commercial pumps work best with water higher than an inch or two. If the water is only about ankle-deep or lower, technicians start with the extraction wands for more efficient removal. Since this is a convenience store with little or no carpet, SERVPRO team members then force any trace amounts of water out the nearest exit using long-handled squeegees.

Next, one of our inspectors determines if there is any permanent damage to floor trim, paneling, or ceiling tiles. Each of our team members can quickly remove affected building material with a minimum of disruption to the rest of the store.

For equipment that is wet, but otherwise undamaged, our personnel set up fans inside to force the damp air outside. It lowers the humidity and speeds up the normal evaporation process. To further increase the rate of drying, technicians also set-up air movers to force warm, dry air across and under equipment and shelving.

It doesn't matter how flood water entered into it, our goal at SERVPRO of Carrollton and Bent Tree is to help you reopen so you can begin supporting your customers once again.

If you require our services, call us at (972) 446-0383 today to schedule a visit.

Commercial Cleaning for Property Management Companies in Dallas.

3/23/2022 (Permalink)

The commercial property business in Dallas is competitive, and no leasing company wants to have empty buildings and vacancies if they can avoid it. The first impression a potential customer gets of a building is the most important. If there is a funny odor, dirty carpets or dust, or other signs of neglect or disrepair, the customer will think the property is not maintained, and you could lose the deal.

SERVPRO® of Carrollton offers a full range of deep cleaning services to keep Denver properties looking and showing their best. We can send in a team to deep clean and deodorize your property quickly and efficiently. You will have confidence knowing that the property is looking and showing at its best!

Commercial Cleaning Services

- Air Ducts and Heating, Ventilation, Air Conditioning (HVAC)

- Biohazard and Sewage

- Trauma and Crime Scene

- Carpet and Upholstery

- Drapes and Blinds

- Ceilings, Walls, and Hard Floors

- Odor Removal and Deodorization

- Vandalism

We have many years of experience working in all kinds of business settings and buildings:

- Small Office Buildings

- Large Office/High-Rise Office Buildings

- Apartment Buildings

- Restaurants

- Hotel/Motels

- Small Retail Stores

- Large Retail/Big-Box Stores

- High-Rise Residential

- Manufacturing and Industrial

- Government/Military

Call Us!

When your commercial property or home needs deep cleaning services, SERVPRO® of Carrollton and Bent Tree is Here to Help. ® Call us today at 972-446-0383.

Franchises are independently owned and operated.

Why Do Gyms and Fitness Centers Need Deep Cleaning Services?

3/11/2022 (Permalink)

Blog Summary: SERVPRO of Carrollton stresses the priority of having trained and certified technicians deep clean fitness centers during the COVID crisis.

SERVPRO of Carrollton is a respected provider of commercial cleaning and property damage restoration services, such as water removal and fire damage cleanup. The team of cleaning experts at SERVPRO is committed to ushering in a new standard of clean through their defensive pathogen cleaning program. The Certified: SERVPRO Cleaned program enables businesses to remain open, clean, and safe.

Gyms and fitness centers, as high-risk environments for the transmission of COVID-19 and its contagious variants, have been hit hard by the pandemic. Health experts at Everyday Health explain the situation: “Throughout the COVID-19 pandemic, gyms and fitness centers have been places where the risk of transmission of the novel coronavirus is high. People get sick with COVID-19 when respiratory droplets and aerosols carrying the virus come in contact with the eyes, mouth, and nose. And gyms are high-touch, close-proximity spaces where vigorous exercise increases the range at which people exhale respiratory particles because they’re breathing more heavily...”

Gym and fitness center risk factors include:

- High concentration of people

- High-touch environment

- Close-proximity activities

- Elevated respiration rate and intensity

- Asymptomatic carriers

Although fitness centers have been hit hard by COVID-19, people are still eager to stay in shape and enjoy community with like-minded enthusiasts. Cleaning, disinfecting, and sanitizing options are available to overcome these risk factors so people can achieve their health and fitness goals.

The Workout Environment: A Bacteria Breeding Ground

Free weights, pull-up bars, exercise machines, and other workout equipment are contaminated with viruses, bacteria, and fungi. The floor, too, can harbor a high concentration of germs. A thorough and rigorous cleaning protocol is crucial to prevent the spread of the novel coronavirus, its variants, and other infectious illnesses such as the common cold and the flu.

Common Germs in the Gym

A common contaminant in the typical fitness center is E. Coli, which is found on many touchpoints in the workout area. Exercise equipment can facilitate the spread of staph infections. The floors in the locker room, showers, and sauna can spread candida, a yeast fungus that causes athlete’s foot. Strep throat can be transmitted from doorknobs and handles on workout machines. Infectious respiratory droplets from sneezes, coughs, or talking can infect others with influenza or COVID-19. Thankfully, early detection and intervention go a long way to treating these ailments.

Cleaning and Disinfecting: What Is the Difference?

A hygienic fitness center is achieved with both cleaning and disinfecting. Cleaning removes germs, body fluids, dirt, and grime from equipment and other surfaces. Contaminants are manually wiped away with a cloth, brush, or sponge using water and a detergent. Cleaning lowers the germ count, reducing the risk of infection, while disinfection actually kills most germs and viruses on the various surfaces in the fitness center. Nonporous surfaces such as glazed tiles, plastic, metal, marble, and glass can be disinfected.

What Cleaning and Disinfection Products Are Best?

Safe and effective EPA-approved disinfectants are best. The label lists what bacteria and viruses the disinfectant kills and provides instructions on proper usage. Disinfectants have a contact time which refers to how long the product must remain visibly wet on a surface in order to work. Successful elimination of germs depends largely on following the directions found on the product label.

The Need for Personal Protective Equipment

Exposure to harsh chemicals and contaminated surfaces is a risk hazard for cleaning staff. They should receive adequate training and wear personal protective equipment (PPE) while cleaning and disinfecting the facility. This equipment includes:

- Gloves

- A mask or face shield

- A gown or coveralls

- Eye protection such as goggles

These measures protect workers from accidental splashes. PPE should be thoroughly disinfected or discarded after use to limit cross-contamination.

Important Cleaning and Disinfecting Recommendations

Surfaces to be wiped down with an EPA-approved disinfectant include workout equipment, countertops, faucet handles, light switches, and doorknobs. Proper disinfecting techniques should be followed. Prevent recontamination by wiping in one direction. Spray surfaces and be sure to allow for the recommended contact time. To prevent members from experiencing skin or eye irritation from the disinfectant, consider flushing the equipment with soap and water to remove the dried disinfectant.

Prescribe a daily routine of cleaning and disinfecting. Documentation and accountability will ensure consistency, and consistency will limit infection. Some training and exercise equipment may need to be disinfected many times a day. A clean, safe facility with a documented cleaning protocol may reduce exposure to potential litigation stemming from sickness traced to the facility.

Fitness center members can do their part to limit the spread of disease by following the following these easy steps:

- Create a barrier between the machine and the skin with a towel.

- Clean each machine with a disinfectant wipe after each use.

- Avoid touching the face, eyes, mouth, or nose during the workout.

- Wash hands after the workout.

Fitness center facility managers should consider securing the services of a reputable, certified professional cleaning company for periodic deep cleaning. The Certified: SERVPRO Cleaned Program is a defensive pathogen cleaning strategy dedicated to ushering in a new standard of clean to keep people safe and confident when they enter a business, professional office, workspace, daycare, school, or fitness center.

Gyms and fitness centers in Farmers Branch, TX, and the surrounding area can learn more about SERVPRO of Carrollton’s commercial cleaning services by emailing office@SERVPRO10952.com. The office can also be contacted by phone at (972) 446-0383. In addition to cleaning and disinfecting services, SERVPRO of Carrollton provides damage restoration services, including fire, storm, and water damage restoration.

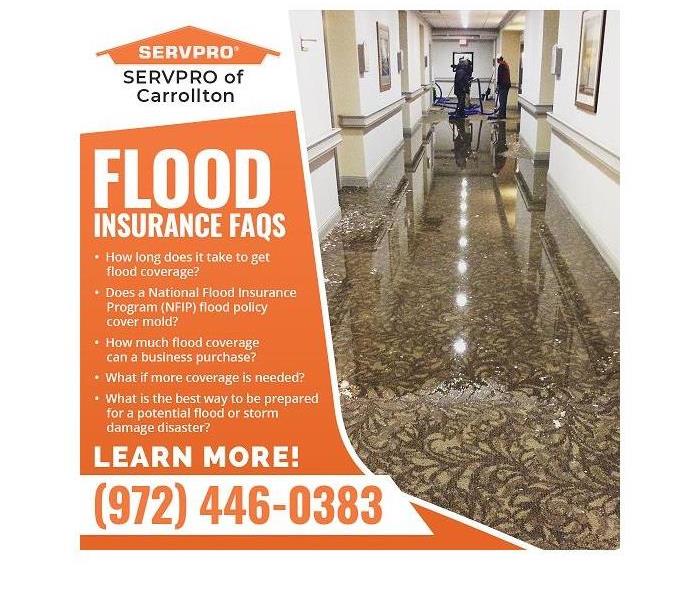

Answering Business Owners’ Questions About Flood Insurance and the Damage Restoration Process

2/1/2022 (Permalink)

Blog Summary: SERVPRO of Carrollton provides answers to questions business owners frequently ask about insurance coverage for flooding, as well as flood restoration services.

When a natural disaster such as flooding strikes, business owners need immediate flood restoration services to get their company up and running. The team of professionals at SERVPRO of Carrollton answers frequently asked questions that business owners commonly have about flood insurance coverage and flood restoration services.

A natural disaster can devastate a business. Production, sales, and service are interrupted while equipment, raw goods, and inventory can be damaged or destroyed. A massive natural disaster such as a hurricane or the recent freeze of February 2021 immobilizes an entire supply chain. With the economic challenges stemming from the pandemic shutdown, an additional disruption of the revenue cycle may shut the doors of a business.

Margins have never been tighter. Clarity about what a commercial property damage policy covers is crucial for continued business success. Damage resulting from certain types of natural events is usually covered by commercial property insurance. Lightning and wind are two examples. Damage caused by other types of natural events, such as flooding, is not typically covered under a standard policy. A special policy is required if protection from flood damage is desired.

The Q&A below sheds light on commercial property damage coverage. The goal is to assist business owners in determining whether expanded coverage is needed.

Flood Insurance FAQs

Q: Is flood coverage included in a standard commercial property insurance policy?

A: Flood damage caused by a storm surge from a hurricane or tropical storm generally is not covered under a standard commercial property damage policy. Hurricane-generated storm surge damage also is outside the coverage parameters of the Commercial Package Policy (CPP) or a Business Owners Policy (BOP). Coverage for flooding can be procured through the National Flood Insurance Program (NFIP) provided by the Federal government.

Q: What does flood insurance cover?

A: Damage to a structure or structures and their contents caused by the flood is covered by flood insurance. Losses stemming from the following situations are covered by Federal flood insurance:

- Severe or prolonged precipitation

- Overflow from streams or rivers

- Hurricane-generated storm surge

- Snowmelt

- Clogged or blocked storm drainage systems

- Ruptured levees or dams or other similar causes

Certain specifications must be met for the event to qualify as a flood. The floodwaters must cover at least two acres or impact at least two properties. Standard commercial property damage insurance will cover water damage if the water originates from above. A standard commercial property damage policy will generally cover gutter overflow from rain or melting snow that leaks onto inventory and damages it.

Q: What is not covered by flood insurance?

A: Property outside the building generally will not be covered. Damage to company vehicles can be included in the optional “comprehensive” portion of a business’ vehicle insurance. Losses stemming from business interruption are not covered. Loss of use of the insured property is also outside the scope of flood insurance.

Q: Is the purchase of flood insurance mandatory?

A: Purchasing flood insurance is mandatory if:

- the commercial property is in a high-risk flood area

- the business has a mortgage from a federally regulated or insured lender

Q: How does a business owner determine the risk hazard for flood damage?

A: The primary factor in determining a business’ risk of flood damage is location. Flood map search tools will help the business owner or manager identify whether the location is in a flood zone. The location of equipment, machinery, and inventory must be factored into the risk analysis. If the area where the equipment and inventory are located is vulnerable to flood damage, the risk of damage is elevated. Likewise, any items of value stored on the ground floor of a building located in a flood zone are at risk.

Q: Where can flood insurance be procured?

A: Flood insurance coverage from the National Flood Insurance Program (NFIP) can only be obtained through an insurance professional.

Q: How long does it take to get flood coverage?

A: The policy goes into effect at the conclusion of a 30-day waiting period after the date of purchase.

Q: Does a National Flood Insurance Program (NFIP) flood policy cover mold?

A: Yes, but each case is evaluated on its own merits. Pre-flood mold/mildew conditions are excluded from coverage.

Q: How much flood coverage can a business purchase?

A: Commercial flood insurance provides:

- up to $500,000 of coverage for flood-related damages to the building

- up to $500,000 for contents

Q: What if more coverage is needed?

A: A business can purchase excess insurance coverage for the purpose of rebuilding a property valued above NFIP limits. The excess coverage policy includes protection against business interruption.

Q: What is the best way to be prepared for a potential flood or storm damage disaster?

A: SERVPRO of Carrollton advises business owners to consult with a local insurance professional about the business’ insurance needs. If the physical location of the business warrants obtaining flood insurance from NFIP, the insurance professional can take care of the process from start to finish.

A proactive approach to flood restoration services involves pre-qualifying a damage restoration company before a disaster strikes. SERVPRO will work with a business to create a plan of action in case of a flood disaster. This Ready Plan includes information, preparation, training that will put a company in the best position to deal with a flood damage disaster. The crews at SERVPRO of Carrollton stand ready 24/7, 365 days a year, to serve clients when disaster strikes.

For more information about commercial damage restoration, contact SERVPRO of Carrollton by emailing office@SERVPRO10952.com. The team can also be contacted by phone at (972) 446-0383.

Five Common Causes of Commercial Property Water Damages.

1/21/2022 (Permalink)

A commercial property can sustain damage from many sources. Here are the five most common causes of water damage, from a broken pipe to sprinklers, toilets, and drainage, along with tips for mitigation and preventing damage from recurring.

1. Broken Pipes

A pipe break can cause extensive damage in a short period of time. Shut off the water and contact a plumber for water repair. An owner may also want to call a damage mitigation company and notify the insurance company. Even if a broken pipe is not a covered peril, the damage that it causes should be covered.

2. Fire Sprinklers

Sprinkler systems can accidentally activate or leak. Unless there is a fire, an owner or manager should shut off the water and contact the sprinkler company. Have sprinklers regularly inspected and maintained to prevent accidental activation.

3. Toilet Overflow

Toilet backups and overflows are caused by sewer blockages, supply line issues, or broken components. In addition to regular maintenance, a facility manager may want to post signage about which materials should not be flushed and provide trash containers in stalls.

4. Sewer Backups

A sewer backup may be caused by a blockage in the line from a building or in municipal mains. Either way, it is important that a commercial building have a functional sump pump. Some structures may also have a back flow valve. Test flood prevention systems on a regular basis.

5. Ineffective Drainage

A drainage system should be cleared at least twice a year. The landscape should also be graded to direct runoff away from the building. An owner may want to have landscaping modified to prevent flooding.

These are the most common causes of water damage to commercial buildings in Far North Dallas.

If a broken pipe or any other system results in damage, the owner or facility manager should contact a mitigation and restoration company.

Commercial Properties can be at risk to Damage from Water because they are Vacant.

1/11/2022 (Permalink)

As an owner of a commercial property, like an apartment complex or retail space, you want to make sure any water damage is taken care of quickly.

So, call our licensed, bonded and insured technicians today and we will arrive within an hourto begin implementing services. Please call us at 972-446-0383.

Prepare for Power Outages In Your Building During Storms

Our techs want you to be aware that storms and other severe weather can overload your power grid, causing power outages and blackouts.

You can prepare for this by installing a standby generator, which will allow you to continue to have some electricity to run the essentials if a storm does cause you to lose power.

Having a generator in the building can even reduce your chances of incurring flood damage because it will keep your sump pump running during heavy storms.

Generators are installed outside your property and powered by liquid propane or natural gas. It is then wired directly to your household’s electrical system, allowing it to automatically restore power within seconds of an outage.

If it seems too expensive to buy a large generator, you can opt for a smaller, portable one. They’re fueled the same way as the permanent ones, and are powerful enough to keep a few appliances and lighting up and running.

If you experience a power outage and find yourself dealing with subsequent leakage or flooding damage, call our commercial property damage Dallas techs and we will begin same day services to get your building cleared of all moisture.

Make sure that your commercial insurance coverage meets the minimum limits for any event that might occur during a storm or freeze.

Ten Strategies for Selecting a Commercial Restoration Company in the Dallas Area

12/13/2021 (Permalink)

Blog Summary: SERVPRO of Carrollton highlights ten factors that property managers need to consider when choosing a commercial property damage restoration company.

SERVPRO of Carrollton understands the stress property managers undergo when a commercial property damage disaster occurs. Tenants demand results so their businesses can be up and running as quickly as possible. Time is money, and the loss of a customer can be financially devastating to a business. Listed below are ten tips to help Dallas, TX, property managers select a commercial damage restoration company that best fits the needs of the properties for which they are responsible.

How to Choose a Commercial Property Damage Restoration Company

#1. Real people

A reputable service provider will have customer service representatives who are always available and who are competent to start the restoration process moving forward in minutes. When tenants are calling about a water damage disaster, the property manager wants to speak with a person, not voicemail that promises a call back at the end of the day.

#2. Rapid response

A rapid response within an hour or less that is offered 24/7, 365 days a year, including on holidays, is a non-negotiable priority. Disasters seem to strike at the most inconvenient times. A delay of just a few hours in the response time can add thousands of dollars and days to the restoration process. Secondary advanced damage and a mold infestation can be avoided in most cases if the restoration team is able to arrive on the scene within an hour.

#3. Reliable assessment and estimate

A trustworthy company will provide the customer with a damage assessment and a detailed written estimate with digital documentation (both images and video). Look for a company that uses an industry-standard estimating software such as Exactimate.

#4. Responsible handling of the insurance claims process

Choose a company that has the capability and willingness to handle the insurance claims process from beginning to end. The property manager’s work never stops. A property damage disaster at a location may involve several tenants, adding multiple layers of complexity to the project. Hire a service provider that has staff who are trained and experienced in handling the claims process.

#5. Reasonable rates

The cost of the cleanup and restoration should reflect the nature and extent of the damage. More extensive damages should cost more to clean up and repair. Cash discounts signal trouble. Cutting costs to win a contract may result in a company cutting corners on the project. When health and safety are involved, thorough cleanup and restoration cannot be compromised.

#6. Respectful and courteous customer service

During the damage cleanup and restoration, the damage restoration company functions as an agent and representative of the property management company. Select a restoration company that has cultivated a culture of respect, courtesy, and empathy. Small business owners and managers affected by the disaster often regard their business and employees as family. For employees, their job is much more than a paycheck. Caring customer service should be a priority when selecting a property damage restoration company.

#7. Right equipment

Choose the company with state-of-the-art equipment. The right equipment for the job effectively leverages the workforce and speeds up the cleanup and restoration process. Advanced moisture-detecting technology measures and validates the proficiency of the drying process. Unacceptably high levels of residual moisture can foster a mold infestation.

#8. Relevant professional certifications

When pre-qualifying a damage restoration company, ensure they have the relevant IICRC industry certifications. A worthy company will have certifications in water, fire, smoke, mold mitigation, and biohazard cleanup as a foundation. Request a list of the company’s certifications with a brief description of each item.

#9. Restoration and reconstruction services

The property manager that chooses a company with proficiencies in both damage restoration and reconstruction services will find the project is more efficient, less time-consuming, and more cost-effective. Communication is streamlined, reducing confusion, delays, and frustration.

#10. Reviews and references

Choose a restoration with a solid relationship with customers and a favorable reputation in the community. Read both negative and positive online reviews. Pay attention to a restoration company that makes a concerted effort to resolve complaints to the customer’s satisfaction. Request references from past clients, and contact the references for personal testimonies about the quality of service. Is the company a good corporate citizen and involved in improving life in the local community?

Property managers can trust the restoration experts at SERVPRO of Carrollton for commercial water, fire, storm, and commercial damage restoration. They offer a rapid response 24/7, 365 days a year, including holidays. The local SERVPRO franchise can scale without delay to meet the challenges of any size commercial property damage disaster. The highly trained restoration technicians possess the knowledge, expertise, experience, and equipment to handle every type of disaster. A trusted leader in the restoration industry, SERVPRO of Carrollton is locally owned and operated. The technicians live in the community and care about the people they serve.

To learn more about commercial damage restoration in Dallas, TX, contact SERVPRO of Carrollton by email at office@SERVPRO10952.com. The office can also be reached by phone at (972) 446-0383

The Importance of Fast Action in the Commercial Damage Remediation Process

11/23/2021 (Permalink)

Blog Summary: When a Carrollton, TX, business suffers a water, fire, smoke, or storm damage disaster, the business owner can rely on SERVPRO of Carrollton to respond quickly, even in situations that necessitate the client being placed on a waitlist.

Commercial damage restoration in Bent Tree, TX, is an essential service for businesses that have experienced water damage, fire and smoke damage, storm damage, or other property damage disaster. For commercial restoration to be most effective, the project must be started and completed promptly to avoid costly secondary damage, loss of inventory, disruption of business processes, and customer dissatisfaction.

A rapid response is always important in property damage remediation, but a commercial facility has different reasons for needing quick restoration than a residential property. For instance, homeowners want to be able to shorten their hotel stay so that they can return to their home and normal life; in contrast, business owners want to minimize the time that they are not able to conduct business. For a business, costs include not only the actual costs of the restoration project but also the loss of profit that could have been made during the time that business operations were disrupted.

An IICRC Certified Firm, SERVPRO of Carrollton is available to provide commercial restoration services 24 hours per day, 7 days per week, and 365 days per year, including on holidays. Technicians rely on their years of training and industry experience to provide a property damage restoration solution that suits the unique situation of the commercial client. Advanced equipment is utilized to thoroughly remediate the damage and enable the business to reopen.

Customer service is foundational at SERVPRO of Carrollton, whether the client needs water damage restoration at a small single-family home or fire damage restoration at a large commercial facility. When business owners or property managers work with SERVPRO of Carrollton, they are consistently pleased by the level of care and competence that the team exhibits. One commercial client wrote of SERVPRO of Carrollton’s services, “They did amazing work and worked and communicated with us successfully throughout the whole process. Thank you SERVPRO!”

How Does SERVPRO of Carrollton Manage Multiple Clients That Need Services?

In some situations, a commercial client has to be placed on a waitlist due to demand for restoration services. The increased demand can result from various factors, such as a storm that has affected businesses across the county. However, SERVPRO still delivers a rapid response that rivals the service of its competitors.

A client posted the following review of SERVPRO of Carrollton’s response to a water damage disaster that had occurred at an office building: “Our office building had a pipe break during the snowstorm. It was a multi-floor flood. SERVPRO put us on a waitlist but responded within 36 hours, as soon as there was an opening. There were other companies that waitlisted us but never responded afterwards. SERVPRO was very professional, thorough, and prompt. Their technicians were polite, informative, and honest. I highly recommend SERVPRO of Carrollton!!”

Can SERVPRO Provide Large Loss Restoration Services?

For large loss situations, SERVPRO of Carrollton can draw on the structure and resources of the SERVPRO Commercial Large Loss Division, which is composed of prequalified restoration specialists. Each large loss project is equipped with a commercial operations manager who supervises the process and ensures that communication and remediation are implemented rapidly and seamlessly. Having the ability to deploy highly-trained industry veterans and strategically cut expenses is part of the SERVPRO difference. SERVPRO’s large loss program has served a diverse assortment of clients from industries including property management, hospitality, the military, universities, and municipalities.

Listed below are some recent natural disasters that SERVPRO’s Disaster Recovery Team has responded to:

Hurricanes and Tropical Storms

- 2021 Hurricane Ida

- 2017 Hurricane Irma

- 2017 Hurricane Harvey

- 2016 Hurricane Matthew

- 2012 Sandy

- 2008 Ike

- 2005 Katrina/Wilma/Rita

Floods

- 2015 Carolina floods

- 2010 Nashville floods

- 2007 Chicago floods

- 2007 Ohio floods

Fires

- 2017 California wildfires

- 2007 California wildfires

The combination of serving the local community and drawing on national resources creates a damage restoration experience that is reassuring for business owners. A SERVPRO of Carrollton representative states, “We’re locally owned and operated and can respond immediately to your emergency. Being locally owned, we make every effort to stay involved in the community, providing our time and services when needed. We remain vigilant about giving back to our community at every opportunity, and we love being a part of the Carrollton community!”

To contact SERVPRO of Carrollton about commercial damage restoration in Bent Tree, TX, email the office at office@SERVPRO10952.com. Staff can also be reached by phone at (972) 446-0383

Commercial Property Destruction

11/5/2021 (Permalink)

SERVPRO may be known as a fire and water restoration company, but did you know we also provide commercial cleaning services for trauma, crime scene, and vandalism?

As a business owner, these situations are not ideal for any company and you want to make sure they are taken care of immediately. That's why SERVPRO is ready 24/7 with the specialized training and equipment to safely clean these messes and get you back to business.

Some of the cleaning services we provide include, but are not limited to:

*Blood, bodily fluids, and tissue remnants

*Fire Extinguisher residue

*Tear gas and pepper spray residues

*Destruction of property

*Odor removal and deodorization

*Spray paint removal from exterior walls, walkways, glass, etc.

Such trauma, crime scene, and vandalism instances can range from bloody noses to complete destruction of property. Our technicians are highly trained to safely and effectively clean your commercial property as quickly as possible. The core steps taken to properly restore these situations include:

1.) Health and safety of personnel, occupants, workers, and technicians is of upmost importance. The appropriate personal protective equipment and engineering controls are used for proper protection first and foremost.

2.) Documentation is properly maintained prior to clean up (in an accident or crime scene scenario, police have finished processing the situation).

3.) Evaluation and assessment of the effected area and any other area that may be contaminated is conducted to determine the scope of work to be performed.

4.) Isolate and contain the affected areas to prevent cross-contamination.

5.) Removal of contaminated materials or decontamination by cleaning and application of an antimicrobial when removal is not possible.

6.) Application of appropriate government-registered antimicrobial shall be applied to ensure structure, systems and contents are safe for use.

7.) Post remediation evaluation and verification is performed to confirm cleanliness and safety of all areas.

Every trauma, crime scene, and vandalism situation is difficult. If you find your business in this tough situation, we will always treat your property and personnel with the empathy and respect during these trying circumstances.

SERVPRO of Carrollton and Bent Tree is determined to ensure the safety and cleanliness of each situation and make it look "Like it never even happened."

The Benefits of Hiring a Professional Damage Restoration Company in Order to Avoid Liability Risks

10/20/2021 (Permalink)

Blog Summary: SERVPRO of Carrollton advises that businesses hire a bonded, insured, and certified damage restoration company when a property damage disaster occurs.